Think about the accounts payable (AP) invoice process in a typical business.

Often, invoices go to multiple people in the organization rather than being centralized. A recipient manually forwards the invoice to the accounts payable department for coding and review – usually by email. Someone manually enters invoice data into an internal system, the invoices are paid, and filed away – often in a folder.

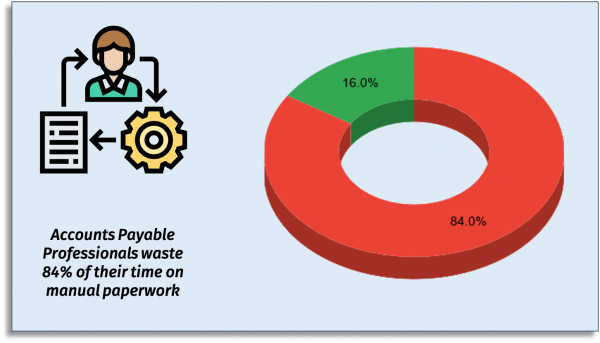

It’s incredibly wasteful, error-prone, and costly. According to the Institute of Finance and Management accounts payable professionals spend a mind-boggling 84% of their time trapped in an endless cycle of manual and semi-automated AP processes, including data capture.

With a modern AP automation solution, your employees can stop wasting time on data capture and manual processes and can instead spend it on work that really matters.

What is Accounts Payable (AP) Automation?

AP automation is a set of procedures and tools to automate the everyday things that your finance team does manually. Things like manually entering invoice data into an Excel spreadsheet and then manually emailing that spreadsheets for an approval signature.

AP automation has been around for years. For example, many businesses use optical character recognition (OCR) technology to reduce manual data entry: scan a paper invoice, and the key data is automatically extracted into the system.

But OCR is still inefficient since you still have to manually process paper, verify the data, and correct any errors.

These inefficiencies have a real dollars and cents impact – many vendors provide early payment discounts, so unnecessary delays in processing invoices reduce your ability to save money by taking advantage of these discounts.

Similarly, it’s easier to benefit from electronic payment savings when the underlying system itself does not rely on manual processing. You’ll also avoid mistakes like making erroneous or duplicate payments.

The good news is: you no longer need massive budgets or large I.T. investments to benefit from automation.

Follow these six accounts payable automation best practices to dramatically increase efficiency, improve compliance, and boost productivity for your AP department.

1. Involve Your AP Team From Day One

Ultimately you need the people in your finance department to actually use your automation solution. Otherwise, you’ll just have created or paid for beautiful shelfware.

People are simply more likely to devote their time, effort, and energy into something that they’ve been able to influence.

Start with a single workflow that’s simple but relatively frequent. Ideally, it should involve several stakeholders and should be an everyday task that they perform routinely during the work day.

Interview the stakeholders and ask them questions like:

- What do you like / dislike about the current process?

- What one or two improvements would have the biggest impact?

- What are the one or two most meaningful sources of delay or errors?

You’ll quickly get a picture of the key areas to focus on automating so you can address real users’ problems.

Include a round or two of user acceptance testing (UAT) so people get a chance to fine tune the solution once they get their hands on it.

Once you’ve rolled out your new automated solution, make sure to periodically review it and continue to solicit feedback. Suffice it to say that you should integrate any usable feedback into your AP solution.

2. Plan for Complexity

Real business processes are almost always complicated.

In practice, there are all kinds of exceptions and special cases for approvals.

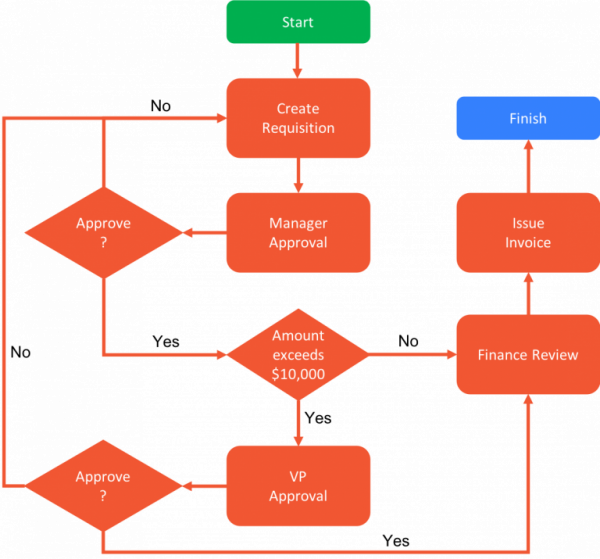

Consider a manager who must approve a purchase requisition for supplies. The request comes in from an employee. The manager could:

- Simply approve the request and forward it to procurement to issue a PO and make the purchase.

- Return the request to the original employee asking for clarifications or corrections.

- Approve the request but obtain one or more additional levels of approval depending on what’s in it. E.g. the grand total exceeds a certain threshold.

- Approve the request but forward it to multiple department heads if individual line items from the purchase requisition are assigned to their budgets.

- Deny the request entirely. (Perhaps the manager knows that the same items were already requested earlier by another employee and this is a duplicate request.)

The reality is that there are almost always multiple options. These rules are usually laid out in an instruction sheet – the first page of a PDF or an Excel tab. They’re long and confusing. People inevitably interpret them incorrectly and either cause delays or, far worse, bypass business standards.

I recommend that you use a workflow diagram to document the workflow you’re automating. A diagram like the one above is incredibly helpful since it makes it easy to communicate a workflow and to get feedback and buy-in.

When discussing a workflow diagram, people will wonder why they even need a particular step or decision point. You’ll weed out unnecessary tasks that have crept in over the years and end up with a simpler workflow. (I’ve seen this happen many times.)

With AP automation tools, you can eliminate confusion and delay since the system encodes these decision points and people don’t have to manually figure out what to do next.

But, it only works if you’ve taken the trouble to document the workflow, simplify to the extent possible, and obtain consensus.

3. Use Modern Software to Automate AP Workflows

Modern automation software goes far beyond technologies like OCR, using online forms and workflows to completely digitize accounts payable processes like invoice and purchase order processing.

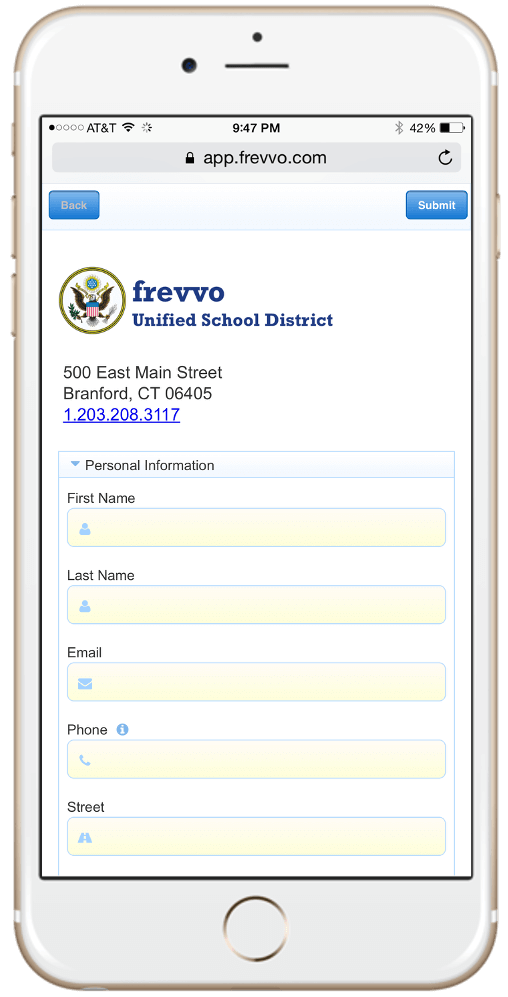

Procurement automation software like frevvo fully automates accounts payable processes to eliminate manual tasks from end-to-end.

- Electronic forms ensure accuracy of your purchase order and invoice data.

- Automated routing, notifications, and escalations remove the need to manually chase down approvals.

- Integration with SQL databases and other business systems decreases unnecessary data entry and the resulting errors.

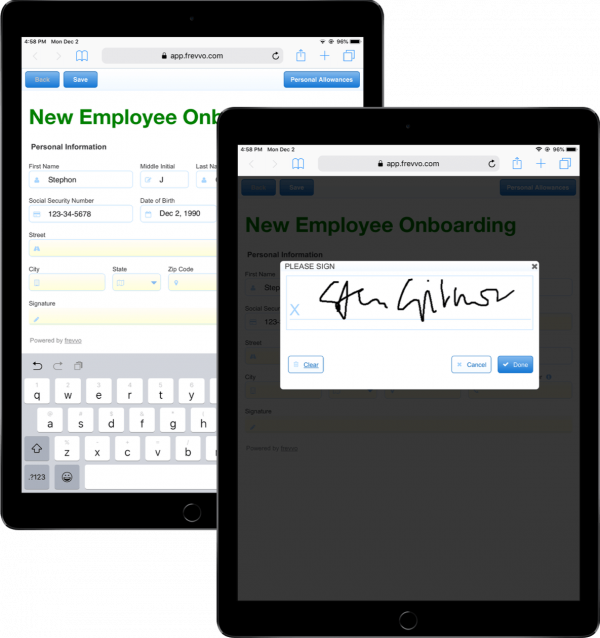

- It’s easy for busy executives to approve and sign on their mobile devices.

- Documents and data are automatically saved to your document management system (including Google Drive) or your accounting system.

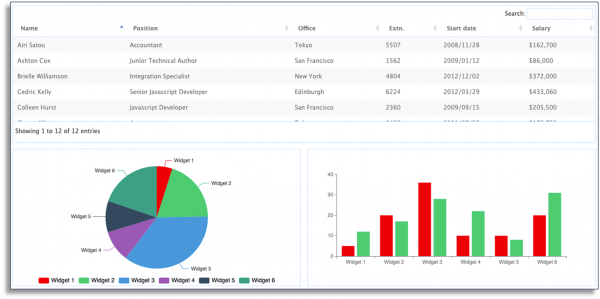

- Built-in reports and dashboards make it easy to monitor KPIs, spot trends, and take rapid action.

Want to automate your accounts payable process?

Anyone can do it with frevvo’s simple, drag-and-drop tools. Try it free for 30 days.

4. Focus on the User Experience

Every user of your automation solution is also a consumer of sleek consumer mobile apps that have a polished user experience.

No one expects an AP automation system to include fancy graphics, but no one wants to go back to a user experience from the 1990s either.

Consider following workflow design best practices to maximize adoption and to create a user experience that makes people’s jobs easier as well as enjoyable.

Focus on Mobile

Mobile devices are ubiquitous in the workplace. With the trend towards remote work accelerating, people increasingly want to perform tasks easily using their phones from any location.

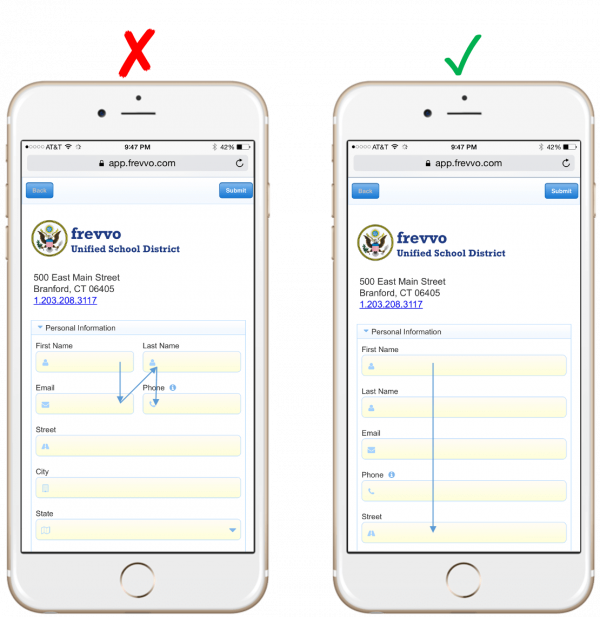

But mobile support shouldn’t just mean creating responsive web forms. Make your workflows easier to use on mobile devices by incorporating these mobile-specific capabilities:

Make everything just a bit larger from clickable buttons to form fields to the font size. Mobile screens are small and tiny little icons and buttons are hard to tap with a finger.

Make fields, especially text area controls big enough to view their entire contents without scrolling. It’s particularly annoying to scroll individual controls inside a mobile form.

Limit the amount of information on a single screen. Most business processes have lengthy forms, so paginate them so people aren’t overwhelmed.

Present a single column layout. It’s easier to scan quickly in a single direction (top to bottom).

Finally, make use of mobile-specific features. We’ve found the most useful ones are letting people sign digitally with their finger on the touchscreen for approval and uploading images captured with the camera as attachments.

Use Thoughtful Design

Don’t complicate people’s lives by making them think about what a particular design element means. Pay close attention to simple things like:

Place all buttons in the same place on the screen relative to the other items in the workflow. Make primary and secondary action buttons the same color everywhere. Obviously, the primary action button should stand out.

Label the buttons so the action is self-explanatory. For example, if clicking a button sends the electronic invoice to a VP for approval, the button label should say “Send to VP for approval” and not just “Continue” or “Next”.

Place labels above form fields rather than to one side. Eye tracking studies have shown that they help users complete tasks more quickly and with less cognitive load.

Where possible, use meaningful icons, placeholder text and contextual help to clarify intent and eliminate confusion. They’ll help reduce errors – a major source of inefficiency, cost, and frustration.

Pay Attention to Performance

“I love watching the spinning wheel while my data loads” said no user ever.

We’re all getting increasingly impatient. Even a few seconds of wait time lead to increased abandonment and an almost irrationally negative experience.

Take the time to test your workflow automation solution under real-world conditions. Make sure it’s fast and responsive, even if that means you have to redesign elements. (For example, you might need to break up a form into two parts or use lower resolution images.)

5. Leverage the Power of Integrations

Data used in AP processes like purchase orders and invoices almost certainly resides in external systems. When your automation system can seamlessly integrate with data and documents saved in external systems, it saves time and improves the user experience.

Auto-fill form data

For example, consider an employee who needs to purchase materials to replenish inventory.

First, they fill out a purchase requisition. A typical requisition contains a table with line items for each part that they need. Filling out the details of each line item manually – internal part number, description, MSRP – is tedious and error prone.

Most people hate typing in unnecessary information and going back to correct errors later. In the above scenario, the data might reside in a SQL database. When the system is integrated with the database, it can pull in this information automatically. Let the employee pick a part from a drop down and avoid typing anything. The drop down options themselves are populated from SQL so they’re always up to date.

When they pick a part, the system can query the database and pull the SKU, description, MSRP and other relevant information and auto-fill it into the form.

Auto-save data and documents

When an AP process completes, it’s very convenient if the data is automatically uploaded to business systems and documents of record (supplier invoices, purchase orders) are automatically stored in a secure electronic document management system.

The system can also notify participants that the workflow has completed and send them relevant documents by email.

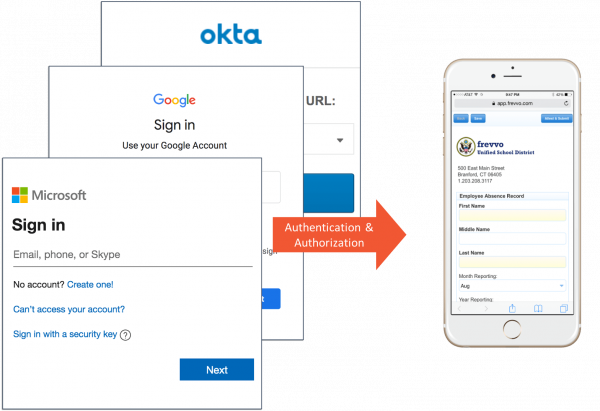

Auto-login to save time

No one wants to remember and manage yet another set of credentials. Worse yet, it creates avoidable security risks.

Choose workflow automation tools that integrate with your existing authentication framework – Active Directory, SAML, etc. If possible, implement single sign on (SSO) so that users are automatically and securely authenticated to the system, their credentials and permissions are managed in one place, and the overall system remains secure.

6. Analyse, Iterate, and Optimize Continuously

No one gets it 100% right the first time. Accounts payable automation, like most things, is a constantly evolving journey. You should be prepared to evolve your workflows to maximize efficiency.

Even though you’ve documented the workflow and obtained consensus, you’ll find that people diverge in their opinions after using the system for a while. They’ll have suggestions for changes and improvements.

Go back and interview real users, ask them about their experiences: what’s truly helpful, and what could make their lives even easier? Implement the best suggestions – nothing delights users more than making a real impact.

The right workflow analysis software can help you pinpoint bottlenecks in the process with graphical reports and dashboards. Maybe the electronic invoice automation process is unnecessarily held up by the CFO. As a result, your company is unable to take advantage of early payment discounts that can save a lot of money.

Armed with real data, you can bring about real and meaningful change in the organization.

It’s especially crucial as your solution matures and you have several AP automation processes in production use.

Final Thoughts

It’s the 21st century and the speed of modern business continues to accelerate. Slow, manual AP automation processes place your organization at a distinct disadvantage in a fast-paced, competitive business environment.

Fortunately, simple and affordable solutions are available so you can reap the massive efficiency benefits of accounts payable automation without needing to make large, upfront investments in software and I.T. staff.Simple workflow automation software like frevvo can make following these best practices a lot easier. Try it free for 30 days.

[Insert CTA]

Ready to spend less time and energy on AP?

Automate your processes with frevvo’s simple, drag-and-drop tools. No coding required. Try it free for 30 days.

The post 6 Proven Accounts Payable Automation Best Practices appeared first on frevvo Blog.